If your Sunlife long term disability benefits have been denied after two years, it could be because the meaning of “ totally disabled ” as required by the insurance policy has changed. Why Were My Sunlife Long Term Disability Benefits Denied After Two Years This happens to many employees, and with the help of experienced disability lawyers, it is something you can fight. This may be shocking news to those who rely on their disability benefits, but it is not uncommon. If you are receiving disability benefits from Sunlife, it is possible those benefits will disappear after two years of receiving them.

Class Action Frequently Asked Questions.  Spectrum Event Medical Services Class Action. Ontario Vice-Chairs and Members of Adjudicative Tribunals Class Action. Vacation and Overtime Class Actions Menu Toggle.

Spectrum Event Medical Services Class Action. Ontario Vice-Chairs and Members of Adjudicative Tribunals Class Action. Vacation and Overtime Class Actions Menu Toggle.

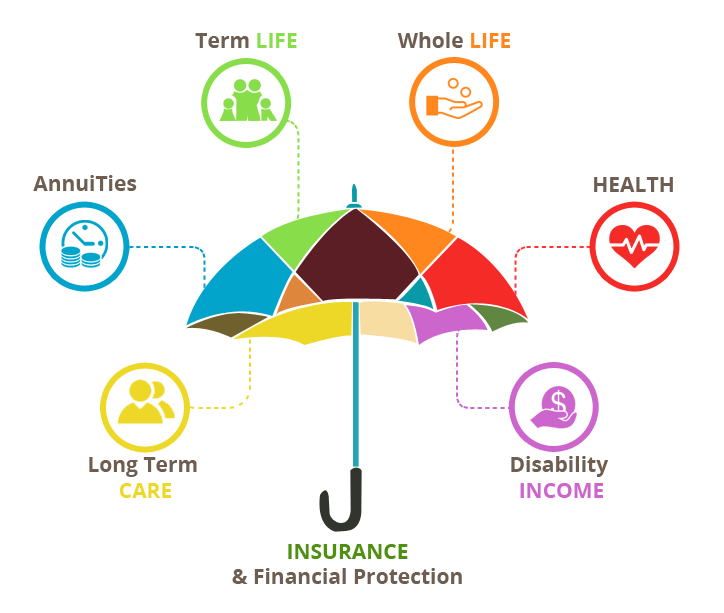

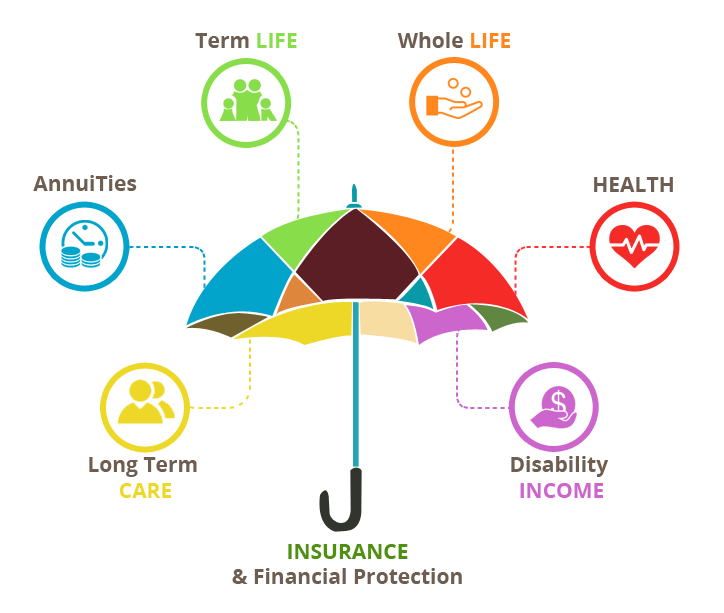

Temporary Help Agencies Class Actions Menu Toggle.Employee Misclassification Class Actions Menu Toggle.Non-Competition and Non-Solicitation Contracts.Visit your local Sun Life website below to submit a claim or to learn about the individual and workplace insurance options available to help protect yourself and the people who depend on you. Disability insurance helps protect your income if you become disabled and can't work.Long-term care insurance helps cover the cost when you require substantial assistance from others due to your diminished physical or mental abilities.

Critical illness insurance helps pay the costs associated with surviving a life-altering illness. Personal health insurance helps pays for health expenses such as prescription drugs, dental and vision care. There are 4 main types of health insurance: Health insurance protects you and your family from the financial impact of illness, accidents and disability. Universal life insurance is a type of permanent insurance. Permanent life insurance policies provide death benefit coverage immediately, plus build up cash value over time. Term life insurance policies are temporary and provide death benefits only. There are 2 main types of life insurance: It is also a crucial component of estate planning. Life insurance helps protect the financial security of the people who matter most, should something happen to you. It helps protect your finances when you're faced with health challenges, and helps safeguard your family's quality of life after you're gone. Insurance is the foundation of your plan for a secure financial future.

Critical illness insurance helps pay the costs associated with surviving a life-altering illness. Personal health insurance helps pays for health expenses such as prescription drugs, dental and vision care. There are 4 main types of health insurance: Health insurance protects you and your family from the financial impact of illness, accidents and disability. Universal life insurance is a type of permanent insurance. Permanent life insurance policies provide death benefit coverage immediately, plus build up cash value over time. Term life insurance policies are temporary and provide death benefits only. There are 2 main types of life insurance: It is also a crucial component of estate planning. Life insurance helps protect the financial security of the people who matter most, should something happen to you. It helps protect your finances when you're faced with health challenges, and helps safeguard your family's quality of life after you're gone. Insurance is the foundation of your plan for a secure financial future.

0 kommentar(er)

0 kommentar(er)